With investors wondering if anything will go right for them this year, Google comes out and knocks it out of the park. A glimpse of light at the end of this dark financial tunnel. Here are a couple highlights from the quarter...

Revenue growth of 31% Y/Y and 3% Q/Q

– Google properties revenue growth of 34% Y/Y and 4% Q/Q

– Network revenues increased 15% Y/Y and 1% Q/Q

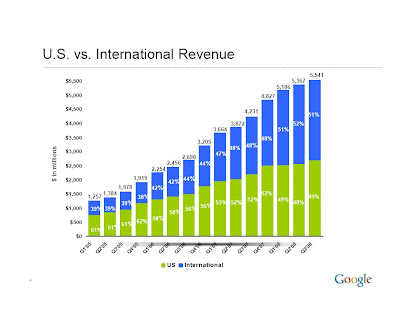

– International revenue was $2.8 billion

Here is what the big wigs had to say about the quarter...

"We had a good third quarter with strong traffic and revenue growth across all of our major geographies thanks to the underlying strength of our core search and ads business. The measurability and ROI of search-based advertising remain key assets for Google," said EricSchmidt, CEO of Google. "While we are realistic about the poor state of the global economy, we will continue to manage Google for the long term, driving improvements to search and ads, while also investing in future growth areas such as enterprise, mobile, and display."

A summary of the numbers...

Google reported revenues of $5.54 billion for the quarter ended September 30, 2008, an increase of 31% compared to the third quarter of 2007 and an increase of 3% compared to the second quarter of 2008. Google reports its revenues, consistent with GAAP, on a gross basis without deducting traffic acquisition costs (TAC). In the third quarter of 2008, TAC totaled $1.50 billion, or 28% of advertising revenues.

Google reports operating income, net income, and earnings per share (EPS) on a GAAP and non-GAAP basis. The non-GAAP measures, as well as free cash flow, an alternative non-GAAP measure of liquidity, are described below and are reconciled to the corresponding GAAP measures in the accompanying financial tables.

-- GAAP operating income for the third quarter of 2008 was $1.74 billion, or 31% of revenues. This compares to GAAP operating income of $1.58 billion, or 29% of revenues, in the second quarter of 2008. Non-GAAP operating income in the third quarter of 2008 was $2.02 billion, or 37% of revenues. This compares to non-GAAP operating income of $1.85 billion, or 34% of revenues, in the second quarter of 2008.

-- GAAP net income for the third quarter of 2008 was $1.35 billion as compared to $1.25 billion in the second quarter of 2008. Non-GAAP net income in the third quarter of 2008 was $1.56 billion, compared to $1.47 billion in the second quarter of 2008.

-- GAAP EPS for the third quarter of 2008 was $4.24 on 318 million diluted shares outstanding, compared to $3.92 for the second quarter of 2008 on 318 million diluted shares outstanding. Non-GAAP EPS in the third quarter of 2008 was $4.92, compared to $4.63 in the second quarter of 2008.

-- Non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, and non-GAAP EPS are computed net of stock-based compensation (SBC). In the third quarter of 2008, the charge related to SBC was $280 million as compared to $273 million in the second quarter of 2008. Tax benefits related to SBC have also been excluded from non-GAAP net income and non-GAAP EPS. The tax benefit related to SBC was $63 million in the third quarter of 2008 and $48 million in the second quarter of 2008. Reconciliations of non-GAAP measures to GAAP operating income, operating margin, net income, and EPS are included at the end of this release.

Congratulations to all the longs... and don't forget that Youtube just passed up Yahoo as the #2 search engine... that is an amazing fact!